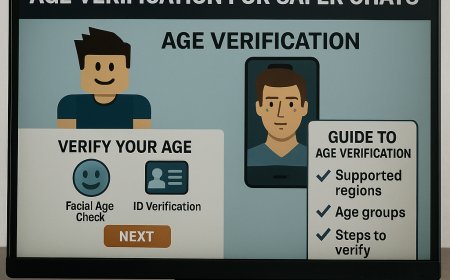

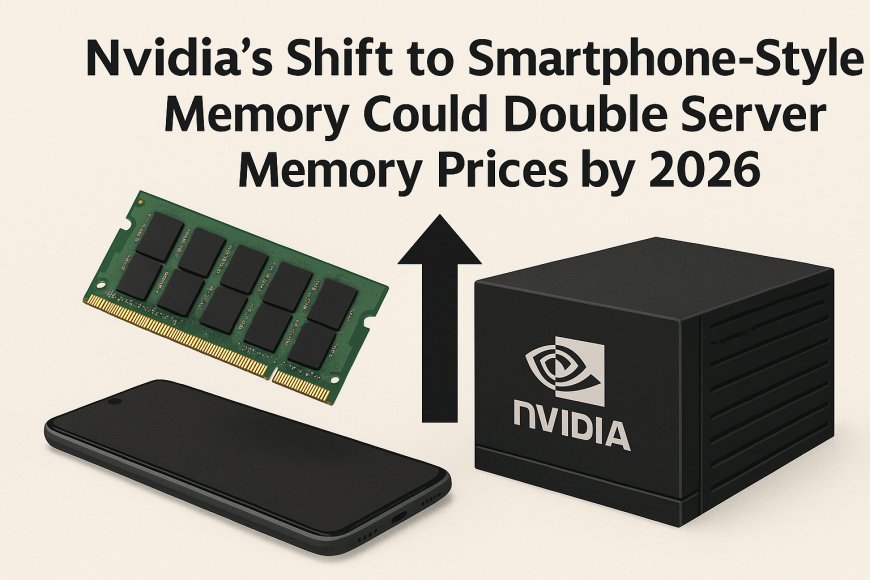

Nvidia’s Shift to Smartphone-Style Memory Could Double Server Memory Prices by 2026

Nvidia’s decision to switch its AI server memory from traditional DDR5 to low-power LPDDR chips—commonly used in smartphones—may lead to a major surge in global memory demand. According to a new report from Counterpoint Research, this shift could cause server-memory prices to double by the end of 2026. The move aims to reduce AI server power consumption, but it also disrupts supply chains already struggling with shortages of legacy memory chips. Manufacturers like Samsung, SK Hynix, and Micron are prioritizing high-bandwidth memory for AI accelerators, leaving limited capacity for LPDDR production. As Nvidia’s demand rises to the level of top smartphone brands, cloud service providers and AI companies may face higher costs and operational challenges.Nvidia’s switch from DDR5 to smartphone-style LPDDR memory chips for its AI servers is set to reshape the global semiconductor market. A new report from Counterpoint Research warns that server-memory prices could double by late 2026 as suppliers struggle to meet sudden increases in demand.

Nvidia’s Shift to Smartphone-Style Memory Could Double Server Memory Prices by 2026

The global semiconductor industry may soon face a major shake-up as Nvidia prepares to change the type of memory used in its artificial intelligence . A new report from Counterpoint Research reveal that the company shift from DDR5 memory to the smartphone-style LPDDR chip could caus server-memory prices to double by the end of 2026. This change is expected to have a significant impact on technology manufacturers, cloud providers, and AI developers worldwide.

Why Nvidia Is Switching to LPDDR Memory

Nvidia’s AI servers play a crucial role in powering advanced applications such as machine learning, data analytics, and generative AI tools. Traditionally, these servers use DDR5, a type of memory designed specifically for high-performance computing systems.

However, Nvidia now plans to move to LPDDR, a low-power memory format that is widely used in smartphones and tablets. The primary reason behind this shift is energy efficiency. LPDDR consumes much less power compared to DDR5 while still offering strong performance. As AI data centres continue to expand rapidly, reducing power consumption has become one of the industry’s top priorities.

A Change That Sends Shockwaves Through the Supply Chain

Although the switch can help Nvidia build more efficient AI servers, it is creating challenges across the global electronics supply chain. Over the past two months, many manufacturers have already been dealing with shortages of older memory chips. Companies shifted much of their production capacity toward high-bandwidth memory (HBM), which is essential for creating advanced AI chips and accelerators.

Counterpoint Research warns that Nvidia’s new move introduces a fresh set of problems. Each AI server requires far more memory chips than a typical smartphone, meaning that the sudden demand from Nvidia could overwhelm current LPDDR production capabilities.

This has already caused a shortage of legacy memory chips. Now, the increased need for LPDDR may force these companies to divert even more factory capacity, squeezing the supply further.

Counterpoint puts it clearly: Nvidia now represents a customer base equivalent to a major smartphone manufacturer in terms of LPDDR demand. This is a “semismic shift” for the industry and one that cannot be easily handled without significant adjustments.

Potential Price Surge by Late 2026

Because supply can't increase quickly enough to match Nvidia’s rapidly growing demand, Counterpoint predicts that server-memory prices could double by the end of 2026. Such a dramatic rise would affect several key markets

Cloud service providers would face higher operational costs.

AI developers may see increased expenses for training and running AI models.

Data centres could struggle to budget for both new hardware and rising electricity costs.

These challenges come at time when companies are already investing heavily in GPUs, cooling systems, and power upgrades to support AI worklods.

A Turning Point of the AI Hardware Market

Nvidia’s decision highlights how quickly the AI landscape is evolving. As companies push for more power-efficient hardware, supply chains must adapt to new manufacturing priorities. If the industry can't scale LPDDR production efficiently, more shortages and price increase may follow.

The coming years will be critical for memory manufactur as they decided how to allocate resources between LPDDR, DDR5, HBM, and other technologies.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0